Understanding Flood Risk: How It Impacts Property and What You Can Do

Flood risk is a critical factor to consider when purchasing or investing in a property. Whether you are a first-time homebuyer or an experienced investor, understanding the impact of flood risk on property value, insurance costs, and safety is essential. In this article, we explore the implications of flood risk and how Area360 can help you make informed decisions.

Flood risk refers to the likelihood of a property experiencing flooding due to natural or human-made causes. Common sources of flooding include:

Flood risk affects various aspects of property ownership, including:

Properties in high flood-risk areas often see lower market demand and resale values. Buyers may be hesitant to invest in homes with a history of flooding.

Home insurance premiums in flood-prone areas tend to be higher due to increased risk. In some cases, insurers may refuse to cover properties with significant flood history.

Lenders often assess flood risk before approving a mortgage. A high-risk property may require additional assessments or even lead to mortgage rejection.

Flooding can cause severe structural damage, mold growth, and long-term habitability issues. Understanding flood zones ensures homeowners are aware of potential risks and mitigation options.

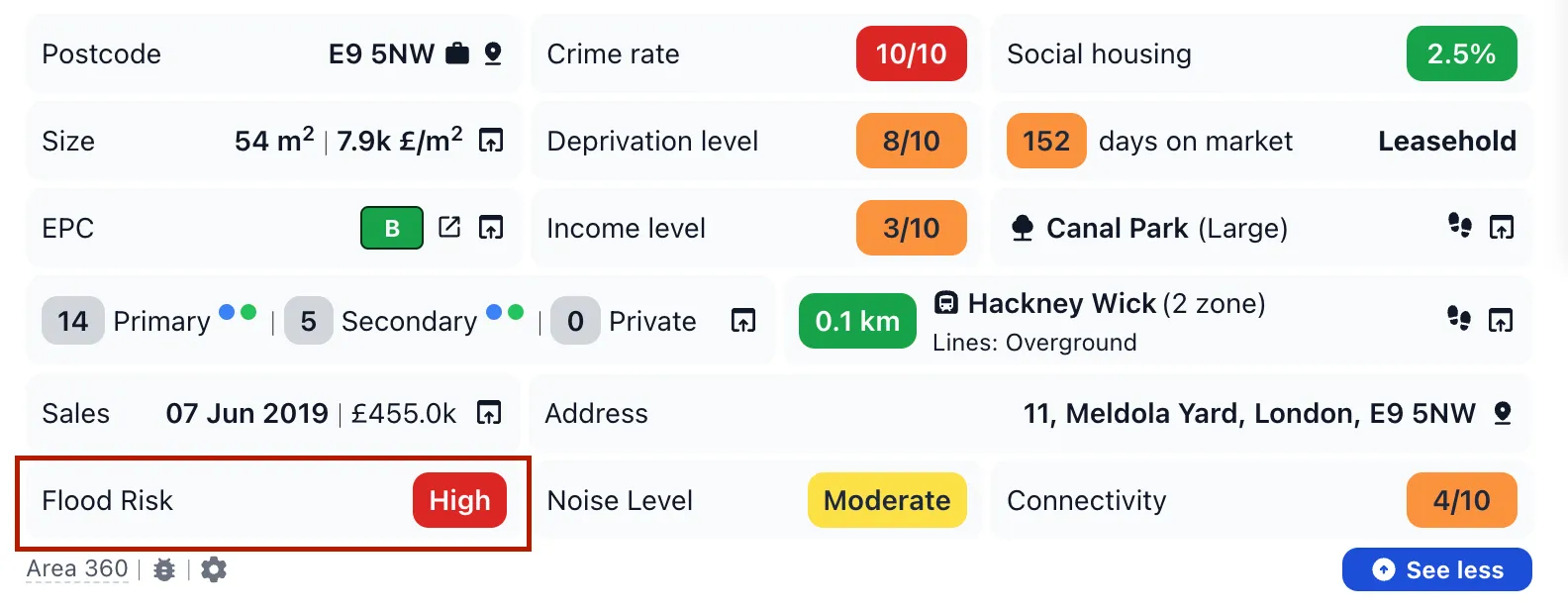

Area360 provide valuable data on property and area-specific risks, including flood risks, crime rates, and environmental factors. By integrating property insights, users can make informed decisions about their prospective homes.

UK Government Flood Map / Live map provides up-to-date flood risk information for properties based on location. Government agencies and environmental organizations publish flood maps highlighting at-risk zones. In the UK, the Environment Agency offers online tools to check flood risks based on postcode.

Assessing the drainage system, including nearby rivers, sewers, and flood defenses, can give a clearer picture of potential risks.

UK Flood History allows users to review past flood events and trends in their area to assess long-term risks. Reviewing past flood records in the area helps determine if flooding is a recurring problem or an isolated incident.

If a property is in a flood-prone area, there are proactive measures you can take:

Understanding flood risk is crucial for homebuyers, landlords, and investors. With tools like Area360, property seekers can access real-time insights on flood-prone areas, ensuring they make well-informed decisions. By assessing risks early and taking preventive measures, homeowners can protect their investments and ensure long-term property safety.